World Bank Group: Origin, Structure, Functions, Challenges and Relevance for India

Content

- Introduction

- Origin and Background

- Structure of the World Bank Group

- Governance and Decision-Making

- Core Functions

- Role in Global Development

- Relevance for India

- Major Criticisms

- Way Forward

- FAQs

Introduction

The World Bank Group (WBG) is one of the most influential multilateral development institutions in the global governance architecture. It plays a central role in financing development projects, reducing poverty, promoting economic stability, and addressing global challenges such as climate change, inequality, and fragile state situations.

For UPSC aspirants, understanding the this topic is important not only from an IR perspective but also for Economics, Governance, and Current Affairs.

Origin and Historical Background

- The World Bank was established in 1944 during the Bretton Woods Conference held in the United States, alongside the International Monetary Fund (IMF).

- The immediate objective was to support the reconstruction of Europe after the Second World War. The institution originally began as the International Bank for Reconstruction and Development (IBRD).

- Over time, as Europe recovered, the Bank’s focus shifted from post-war reconstruction to development financing for newly independent and developing countries in Asia, Africa, and Latin America.

- This transformation marked the beginning of the World Bank’s long-term role in poverty reduction, infrastructure development, institutional reforms, and social sector investments.

Today, the World Bank Group is headquartered in Washington D.C. and functions as a global development partner for over 180 countries.

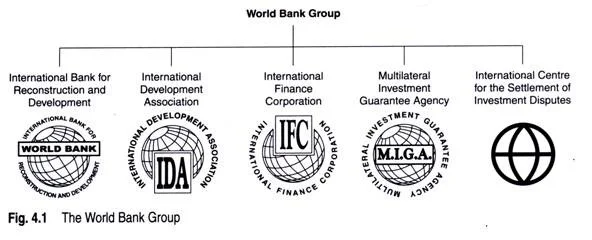

Structure of the World Bank Group

The World Bank Group is not a single institution but a family of five organisations, each with a specific mandate.

- The IBRD provides loans and advisory services to middle-income and creditworthy low-income countries.

- The International Development Association (IDA) supports the poorest countries through concessional loans and grants.

- The International Finance Corporation (IFC) promotes private sector development in developing economies.

- The Multilateral Investment Guarantee Agency (MIGA) offers political risk insurance to encourage foreign investment.

- The International Centre for Settlement of Investment Disputes (ICSID) resolves disputes between governments and foreign investors.

Together, these institutions cover public finance, private investment, risk mitigation, and dispute resolution, making the World Bank a comprehensive development system rather than just a lending agency.

Governance and Decision-Making

The World Bank follows a shareholding system, where voting power is based on the financial contributions of member countries. The United States remains the largest shareholder, followed by Japan, China, Germany, and the UK. This structure gives developed countries greater influence over policy direction.

The highest decision-making body is the Board of Governors, usually consisting of finance ministers or central bank governors from each member state. Day-to-day operations are managed by the Board of Executive Directors.

Traditionally, the President of the World Bank has been an American nominee, reflecting the dominance of the US in global financial institutions. This practice has often been criticised for limiting inclusiveness and representation.

Core Functions and Mandate

- The primary mission of the World Bank Group is to end extreme poverty and promote shared prosperity. It does this through financial support, technical expertise, policy advice, and institutional capacity building.

- The Bank funds large-scale infrastructure projects such as highways, power plants, irrigation systems, and urban development.

- It also supports social sector initiatives in education, healthcare, nutrition, and gender empowerment. In recent years, climate resilience, disaster management, and digital governance have become important focus areas.

- Beyond lending, the World Bank produces influential research reports like the World Development Report and Doing Business (now discontinued), which shape global development discourse and policy reforms.

Role in Global Development and Governance

- The World Bank plays a major role in shaping development priorities across the Global South. Its financial assistance often comes with policy conditions, encouraging economic reforms, governance improvements, and institutional restructuring.

- In fragile and conflict-affected states, the Bank supports post-conflict reconstruction, public service delivery, and economic stabilisation. During global crises such as COVID-19, the Bank mobilised emergency financing for healthcare systems, vaccine procurement, and economic recovery.

- The institution also collaborates closely with the UN, IMF, WHO, and regional development banks, making it a key pillar of the multilateral system.

Relevance for India

- India has been one of the largest beneficiaries of World Bank assistance since independence. The Bank has supported India in areas such as rural development, education reforms, urban infrastructure, sanitation (Swachh Bharat), renewable energy, and health systems.

- In recent years, World Bank funding has been aligned with India’s priorities like climate action, digital governance, and sustainable urbanisation. India is also an active voice within the Bank, advocating for greater representation of developing countries in decision-making structures.

At the same time, India has gradually reduced dependence on World Bank loans due to its growing economic capacity and preference for diversified financing sources.

Major Criticisms and Challenges

Despite its contributions, the World Bank faces significant criticism.

- One major concern is Western dominance in governance, which limits the influence of developing nations. The conditionalities attached to loans have sometimes been accused of promoting neoliberal policies that hurt social welfare.

- Environmental and social impacts of large infrastructure projects have also raised concerns, especially regarding displacement and ecological damage. Although the Bank now follows environmental and social safeguard frameworks, implementation remains uneven.

- Another challenge is balancing development financing with climate responsibilities. Developing countries expect greater climate finance support without restrictive conditions, while the Bank struggles with resource mobilisation.

Reform Debates and the Way Forward

- There is growing demand to reform the World Bank to reflect contemporary global realities. Emerging economies like India, China, Brazil, and African nations seek greater voting power and leadership representation.

- Experts also argue for a stronger focus on climate finance, disaster resilience, and inclusive growth. The Bank is now moving towards blended finance, public-private partnerships, and results-based lending models.

- In the context of global inequality, debt stress, and climate vulnerability, the World Bank’s relevance remains high, but its legitimacy depends on meaningful reforms.

Conclusion

The World Bank Group remains a central institution in global development governance. From post-war reconstruction to climate resilience and digital development, its role has continuously evolved. While its financial and technical contributions are significant, issues of governance imbalance, conditionalities, and social impact continue to generate debate.

For India and other developing countries, the World Bank is both a development partner and a platform for advocating systemic reform. In a rapidly changing global order, the institution’s future will depend on how well it adapts to the needs of the Global South while maintaining credibility and inclusiveness.

FAQs

1. What is the World Bank Group?

The World Bank Group is a multilateral financial institution that provides loans, grants, and technical assistance to promote economic development and reduce poverty worldwide.

2. When and why was the World Bank established?

The World Bank was established in 1944 under the Bretton Woods system to support post-war reconstruction and long-term development.

3. What are the main institutions of the World Bank Group?

The Group consists of five institutions:

IBRD, IDA, IFC, MIGA, and ICSID.

4. What is the primary function of the World Bank?

Its main function is to provide financial and technical support for development projects in sectors such as infrastructure, education, health, and climate resilience.

5. How does the World Bank assist developing countries?

It offers low-interest loans, grants, policy advice, and capacity-building support to improve governance and economic growth.

Click on the question to see the Answers